Avoid financial vulnerability through structured offshore trusts asset protection solutions.

Avoid financial vulnerability through structured offshore trusts asset protection solutions.

Blog Article

Exploring the Conveniences of Offshore Trust Fund Property Security for Your Wide Range

When it comes to guarding your riches, overseas counts on can provide considerable benefits that you could not have taken into consideration. Allow's discover what offshore trusts can do for you.

Recognizing Offshore Trusts: A Primer

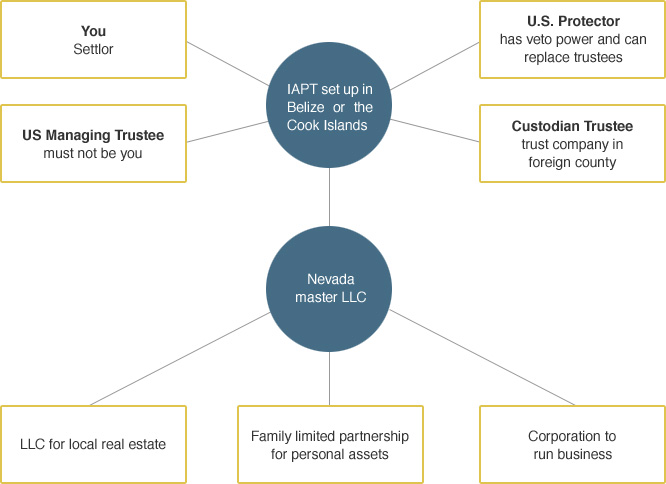

Offshore trust funds provide an one-of-a-kind way to manage and secure your assets, and comprehending their principles is crucial. These depends on allow you to put your wide range outside your home nation, commonly in territories with positive tax laws and privacy securities. When you established an overseas trust fund, you're fundamentally transferring your possessions to a trustee, that handles them according to your defined terms. This framework can help you maintain control over your wealth while minimizing direct exposure to regional obligations and tax obligations.

You can customize the depend fulfill your specific demands, such as picking recipients and determining how and when they receive distributions. Furthermore, offshore trust funds typically supply privacy, protecting your monetary affairs from public scrutiny. By grasping these principles, you can make enlightened choices about whether an overseas trust fund lines up with your possession protection strategy and lasting monetary goals. Recognizing this device is a crucial step toward safeguarding your wide range.

Lawful Securities Used by Offshore Counts On

When you establish an overseas trust, you're using a durable framework of legal defenses that can secure your assets from different threats. These depends on are typically controlled by positive legislations in overseas territories, which can supply stronger defenses against lenders and lawful insurance claims. For example, several overseas trusts profit from statutory securities that make it tough for creditors to access your assets, also in personal bankruptcy situations.

Furthermore, the separation of legal and advantageous possession implies that, as a recipient, you don't have direct control over the properties, making complex any type of efforts by financial institutions to seize them. Many overseas jurisdictions additionally restrict the moment framework in which claims can be made against trusts, including an additional layer of safety and security. By leveraging these lawful securities, you can substantially boost your financial stability and safeguard your wide range from unforeseen hazards.

Privacy and Discretion Perks

Developing an offshore trust not just offers robust lawful securities yet also guarantees a high degree of personal privacy and discretion for your properties. When you established up an overseas trust, your financial affairs are shielded from public scrutiny, helping you maintain discretion concerning your wide range. This privacy is essential, especially if you're worried concerning prospective claims or unwanted attention.

In numerous offshore territories, legislations secure your individual details, meaning that your properties and economic negotiations stay private. You will not have to fret about your name showing up in public records or financial disclosures. Additionally, dealing with a trusted trustee guarantees that your information is handled firmly, additional improving your privacy.

This degree of discretion enables you to manage your wealth without worry of exposure, providing tranquility of mind as you guard your economic future. Eventually, the privacy benefits of an offshore trust can be a significant advantage in today's increasingly transparent world.

Tax Obligation Benefits of Offshore Depends On

One of one of the most compelling factors to consider an overseas trust is the capacity for considerable tax obligation advantages. Establishing an overseas trust fund can assist you minimize your tax obligation liabilities lawfully, relying on the territory you choose. Lots of overseas jurisdictions use beneficial tax obligation prices, and in some cases, you may also take advantage of tax exceptions on income produced within the trust fund.

By moving assets to an overseas trust, you can separate your individual wealth from your gross income, which may decrease your total tax obligation concern. Furthermore, some territories have no resources gains tax obligation, allowing your investments to grow without the instant tax obligation implications you would certainly encounter domestically.

Possession Diversity and Financial Investment Opportunities

By developing an offshore count on, you unlock to property diversification and one-of-a-kind like this financial investment possibilities that might not be offered in your home nation. With an offshore trust fund, you can access numerous global markets, permitting you to purchase property, supplies, or products that may be restricted or less positive locally. This international reach aids you spread out danger throughout various economic climates and markets, shielding your wide range from neighborhood financial recessions.

In addition, offshore trusts usually offer accessibility to specialized financial investment funds and alternative properties, such as private equity or bush funds, which might not be readily available in your home market. This tactical strategy can be important in maintaining and expanding your wealth over time.

Sequence Preparation and Riches Transfer

When taking into consideration how to hand down your wealth, an offshore trust fund can play a crucial function in reliable sequence planning. By establishing one, you can assure that your assets are structured to offer your liked ones while minimizing prospective tax obligation effects. An offshore depend on permits you to dictate exactly how and when your beneficiaries receive their inheritance, supplying you with tranquility of mind.

You can appoint a trustee to handle the trust fund, assuring your wishes are performed also after you're gone (offshore trusts asset protection). This setup can additionally protect your possessions from lenders and lawful obstacles, guarding your family's future. Furthermore, offshore trusts can offer privacy, keeping your monetary issues out of the general public eye

Inevitably, with mindful preparation, an offshore count on can work as a powerful tool to assist in wide range transfer, assuring that your heritage is managed and your enjoyed ones are taken treatment of according to your desires.

Picking the Right Territory for Your Offshore Trust Fund

Picking the appropriate territory for your overseas count on is an essential aspect in maximizing its benefits. You'll want to contemplate factors like lawful structure, tax ramifications, and possession defense regulations. Various jurisdictions offer varying levels of discretion and stability, so it is crucial to study each option extensively.

Search for areas recognized for their beneficial webpage depend on laws, such as the Cayman Islands, Bermuda, or Singapore. These territories frequently supply robust legal defenses and a reputation for monetary safety.

Likewise, consider accessibility and the simplicity of managing your trust fund from your home nation. Consulting with a legal expert concentrated on offshore trusts can lead you in steering via these complexities.

Inevitably, choosing the excellent jurisdiction can enhance your possession protection approach and ensure your wide range is protected for future generations. Make notified decisions to safeguard your economic heritage.

Often Asked Questions

Can I Establish an Offshore Trust Without a Legal Representative?

You can technically establish an overseas depend on without a lawyer, however it's high-risk. You may miss crucial lawful nuances, and difficulties can occur. Working with a professional assurances your trust fund follows guidelines and shields your interests.

What Occurs if I Relocate To An Additional Country?

Are Offshore Trusts Legal in My Nation?

You'll need to check your regional regulations to identify if overseas counts on are lawful in your country. Laws differ extensively, so seeking advice from a legal professional can help guarantee you make educated choices regarding your possessions.

How Are Offshore Depends On Managed Globally?

Offshore depends on are managed by global regulations and guidelines, varying by jurisdiction. You'll find that each country has its own regulations pertaining to taxes, reporting, and compliance, so it's necessary to understand the specifics for your circumstance.

Can I Access My Assets in an Offshore Trust?

Yes, you can access your assets in an offshore trust, yet it relies on the trust fund's framework and terms. You need to consult your trustee to recognize the details procedures and any type of limitations involved.

Conclusion

To sum up, offshore trust funds can be a clever option for safeguarding your wide range. When considering an overseas trust fund, take the time to select the right jurisdiction that straightens with your goals.

Report this page